Search This Blog

Global Translation and Localization Agency in Northern Europe. Baltic Media Ltd. An ISO 9001:2015 Certified Scandinavian and Baltic Language Service Provider. Since 1991.

Posts

Showing posts from 2019

Linguistics: Do We Really Need Grammatical Gender?

- Get link

- X

- Other Apps

Translation and Localization Management Solutions

- Get link

- X

- Other Apps

Finland is renowned for mobile phones, design and Moomins

- Get link

- X

- Other Apps

The Guardian: Clumsy and Insensitive Translations Can Ruin the Enjoyment of a Foreign-language Film

- Get link

- X

- Other Apps

Lexical Distance Among the Languages of Europe

- Get link

- X

- Other Apps

Finnish (Suomi) is a Finnic Language Spoken by About 5 Million People

- Get link

- X

- Other Apps

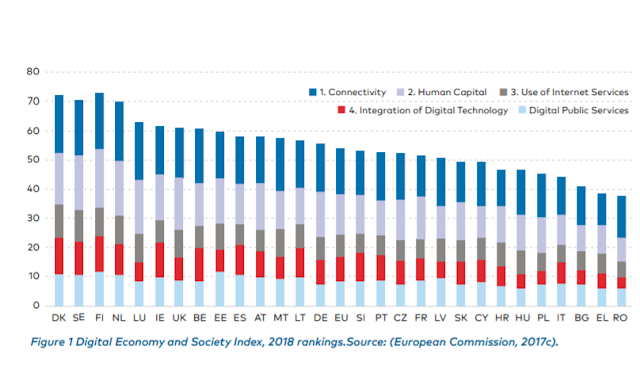

Digitalisation in the Nordic Region—The European and Global Contexts

- Get link

- X

- Other Apps

Translation and Global Marketing Missteps: Don’t let Global Content Missteps Trip You Up

- Get link

- X

- Other Apps